|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Can You Refinance an FHA Loan: Key Considerations and Common MistakesRefinancing an FHA loan can be an excellent way to reduce your monthly mortgage payments, change your loan terms, or even cash out on your home equity. However, understanding the intricacies of the process is crucial to make the right decision. Understanding FHA Loan RefinancingBefore diving into the refinancing process, it's essential to understand what it entails and the potential benefits and drawbacks. Types of FHA Loan Refinancing

Eligibility RequirementsTo qualify for refinancing, you typically need to meet certain criteria, such as a stable income and a good credit score. However, the specific requirements can vary based on the lender and the type of refinance you choose. Steps to Refinance Your FHA LoanRefinancing your FHA loan involves several steps, each crucial to ensuring a smooth process. Evaluate Your Financial SituationConsider using a refinance or not mortgage calculator to determine if refinancing makes financial sense based on your current situation. Gather Necessary Documentation

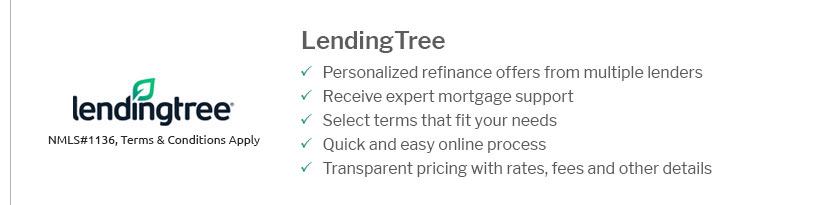

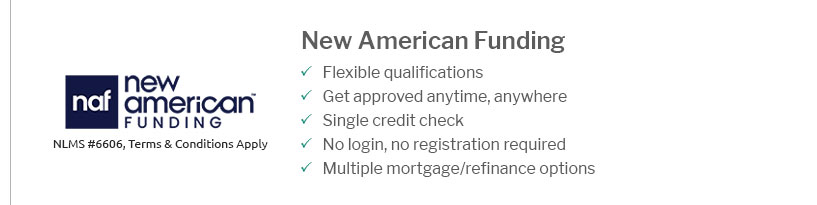

Compare LendersShop around for the best rates and terms. Different lenders offer varying rates, so it's important to compare multiple options. Common Mistakes to AvoidMany homeowners make avoidable mistakes during the refinancing process. Here’s what you should steer clear of:

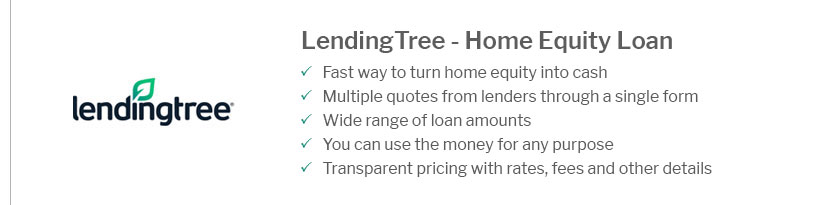

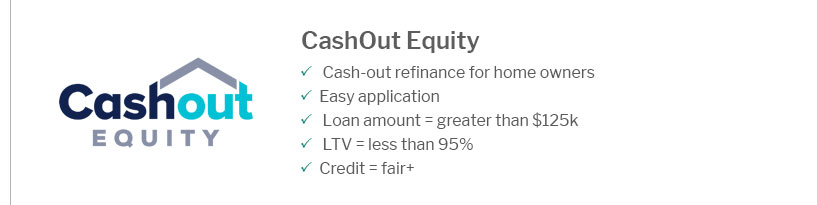

Considering a refinance or second mortgage might also provide different financial benefits, depending on your long-term goals. FAQs About FHA Loan RefinancingWhat is the benefit of an FHA Streamline Refinance?The FHA Streamline Refinance is beneficial because it requires less documentation, no appraisal in some cases, and can offer lower interest rates, making it quicker and easier than traditional refinancing. Can I refinance my FHA loan if I have bad credit?Yes, it is possible to refinance with bad credit, especially if you opt for an FHA Streamline Refinance, which often does not require a credit check. However, it’s advisable to improve your credit score to qualify for better rates. How long does the refinancing process take?The refinancing process can take anywhere from 30 to 45 days, depending on your lender and the complexity of your financial situation. Preparing all necessary documents in advance can help expedite the process. https://www.credible.com/mortgage/refinance-fha-loan

Yes, you can refinance your FHA loan. Two of the most common options include: Refinancing into a conventional loan; Applying for an FHA streamline refinance ... https://www.pennymac.com/blog/lower-your-mortgage-payments-by-refinancing-from-an-fha-to-a-conventional-loan

You can refinance an FHA loan to a conventional loan, but you'll need to meet minimum requirements. If you don't meet the equity minimum for ... https://www.fha.com/fha_article?id=3192

Homeowners should know that if you want to refinance your current mortgage with an FHA Streamline refinance option at least six payments must have been made on ...

|

|---|